Simple Price Action Strategy

This is a very simple price action strategy which can be used by new traders. If you want to trade price action, give it a try without breaking or modifying any rule. There are just 10 simple rules which even a small child can follow without making any mistake.

Rule 1: You will be taking trade as a swing trader and act only when the market shows a clear break in any direction. So trend is your friend. You should never use the strategy to take counter trend trade.

Rule 2: You will use two time frame to analyze and take trade in such a way that there is at least 12 -16 candles combined in lower timeframe to construct the higher timeframe. For example (LTF = 5 min with HTF = 1 Hour or LTF = 15 min with HTF = 4 Hour or LTF = 1 Hour with HTF = 1Day) and so on.

Rule 3: The direction of swing break, is the direction of the current trend. And break must end with a closing candle. This applies for both LTF and HTF structure.

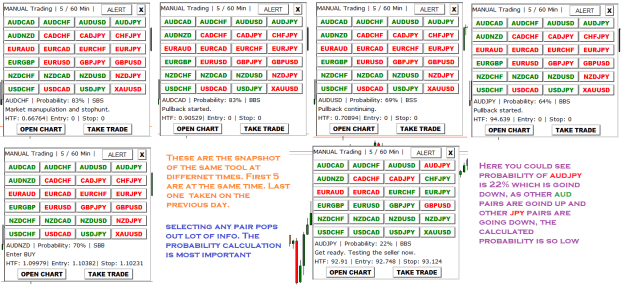

Rule 4: This is a very important rule. You will only take trade in those currency pairs which are moving in the same direction with the other similar currencies comparing them using the HTF (higher timeframe). For example if you want to take trade in EURUSD as BUY, then most of the EUR must be going UP and most of the USD must be going DOWN. Calculate the percentage of EUR pairs going UP and percentage of USD pairs going DOWN and combine to find average percent. Only when the combined average percent is more than 70 %, you are allowed to take trade in that currency pair, else just switch to a different currency pair.

Rule 5: Once you have found the right currency pair to trade using rule 4, now find the latest break in swing structure in your HTF. For example sake, we will be taking HTF = 1 Hour and LTF = 5 Minute. So direction of break in your 1 Hour timeframe is the current market direction, and you need to take trade only in that direction.

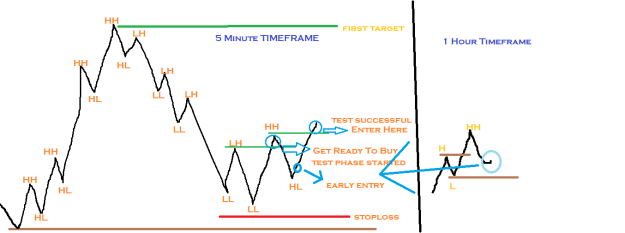

Rule 6: Once you found out the market direction of the currency pair using rule 5, now go to your LTF (Lower timeframe). Now wait for pullback to happen in your LTF in such a way that your HTF direction is still intact. A pullback is necessary. You are not allowed to trade unless you get a pullback. A pullback must break swing structure in your LTF to form a opposite trend. So this is just a waiting phase for you. Wait and observe the market at every step.

Rule 7: After a pullback is established using rule 6 in your LTF and price breaks swing structure in the direction of your HTF for the first time, then get ready. You may get an early entry signal. A break is only defined when the candle close outside your swing point in your LTF. Wicks are not counted. If a wick is formed and price close back inside the swing structure then wait for next candles until a clear close outside swing structure is established in your LTF. Below drawing will help you understand it clearly.

Rule 8: After price break for the first time in your LTF using rule 7, now is time for the test. For the test to be successful the price should give a candle by candle pullback, but the structure direction in your LTF should not change. Only after a candle by candle small pullback , if you get an clear engulfing candle in the direction of the HTF trend, you are allowed to enter your first half of the trade. As the test is not yet complete, w are not sue if the newly formed direction is genuine or fake. That's why only take half of your trade. As shown in the above image. Stop loss outside your last swing which created the first break. Target is your HTF swing from where the pullback has begun.

Rule 9: Now if the price again break swing structurein the direction of the trend, enter rest half of the trade.(refer to the image above). Stop loss at your previous trade stop loss price while take profit is outside our HTF swing , in such a way that at least 1: 2 Risk Reward ratio is maintained.

Rule 10: This is more like a warning, then a rule. Under no circumstance, you are allowed to chase the market. If you fail to enter into the trade at the right moment, and the price has travelled to at lest your HTF swing point, then the trade is over. You have missed your chance. Either stick to your system and look at the charts without getting distracted, or apply some alerts on the chart to alert you on the right price.

It is not that I am writing some random strategy for people to read. I myself also trade everyday using this strategy. I am a day trader and trade using 1Hour and 5 Minute timeframe. It just that I do not do all the laborious manual tasks of calculating probability, waiting for price break, etc. I have my personal tool which use this trading method and pops out alert sound accordingly and provide me with relevant message. As I get distracted while trading and missed my trade entry, I just automated my manual tasks, and now I just make the final decision of either taking the trade or not. You do not need the tool if you are good at staying on your screen without distraction, but if you do get distracted and want the tool then this is how the tool looks.

Remember this tool is not free to use. Still if you want to download for demo test download multipair analyzer here.

In this thread every day I will try to post few trade entry using this price action strategy. So that you could analyze the strategy in real time.

0 Comments